does idaho have inheritance tax

Any amount over the 117 million however is taxable. The inheritance tax exemption was increased from 100000 to 250000 for certain family members effective January 1 2012.

Here S How Long 1 Million In Retirement Savings Will Last In Your State Saving For Retirement Retirement Best Places To Retire

For example if an estate is worth 13 million the estate would owe taxes on the 13 million difference which is taxed at 40.

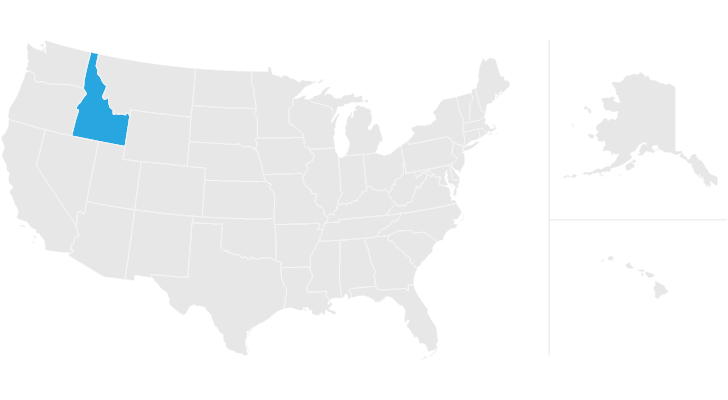

. Idaho does not levy an inheritance tax or an estate tax. Indiana passed laws in 2012 that would have phased out its inheritance tax by 2022. 17 Are capital gains in a trust taxable.

Maryland is the only state to impose both. The deceased person lived in a state that collects a state inheritance tax or owned bequeathed property located there and the heir is in a class that isnt exempt from paying the tax. Idaho has no state inheritance or estate tax.

12 What is the federal tax rate for trusts. Is Idaho tax friendly for retirees. 1 2005 contact us in the Boise area at 208 334-7660 or toll free at 800 972-7660.

Impose estate taxes and six impose inheritance taxes. 11 Is an inheritance from a trust taxable income. 15 Why do I owe Idaho state taxes.

18 What tax rate does a family trust pay. As a result there are 32 states that dont collect death-related taxes. Delaware repealed its estate tax at the beginning of 2018.

Idaho does not levy an inheritance tax or an estate tax. No estate tax or inheritance tax. And if your estate is large enough it may be subject to the federal estate tax.

13 Does Idaho have a property tax break for seniors. But taxes are just one element of the estate planning process. You will also likely have to file some taxes on behalf of the deceased.

Which states do not have state income tax. Finally retirees are eligible for the standard Idaho homeowners exemption she said. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Idaho Inheritance and Gift Tax. Oklahoma does not have an inheritance tax. Some states do have their own inheritance taxes and if you own property in one of those states such as real estate the.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Idaho doesnt have estate or inheritance tax. 16 What state is best to create a trust.

Keep in mind that if you inherit property from another state that state may have an estate tax that applies. Idahos capital gains deduction. And if your estate is large enough it may be subject to the federal estate tax.

Idaho does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as estate taxes without the federal exemption hurt a states competitiveness. The potential INCOME tax rate on that built in gain even if all of it is classified as a capital gain is 26 20 federal.

The state where you live is irrelevant. Only six states currently have an inheritance tax more on this below and there is not a separate federal inheritance tax. Inheritance laws from other states may apply to you though if a person who lived in a state with an inheritance tax leaves something to you.

Page last updated May 21 2019. Idaho has no gift tax or inheritance tax and its estate tax expired in 2004. In Kentucky for instance the inheritance tax applies to all in-state property even for out-of-state inheritors.

Idaho has no state inheritance or estate tax. For tax year 2001 only the deduction was increased to 80 of the qualifying capital gain net income. An heirs inheritance will be subject to a state inheritance tax only if two conditions are met.

Even though Idaho does not collect an inheritance tax however you could end up paying inheritance tax to another state. For more details on Idaho estate tax requirements for deaths before Jan. For those of you who live in Idaho there are several factors that will need to be taken into account to determine how much you would be required to pay.

The top estate tax rate is 16 percent exemption threshold. Idaho allows a deduction of up to 60 of the capital gain net income from the sale or exchange of qualifying Idaho property. Second homeowners who are 65 and older and low income may also qualify for a property tax deferral.

If the difference is say 5000 the estate would pay 18 tax. That tax-friendliness also applies to estates and inherited wealth as the state has no estate or inheritance taxes. 14 Are property taxes high in Idaho.

Idaho also does not have an inheritance tax. Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Hawaii Idaho Indiana Kansas Louisiana Michigan Mississippi Missouri Montana Nevada New Hampshire New Mexico North Carolina North Dakota Ohio Oklahoma South Carolina South Dakota. No estate tax or inheritance tax Illinois.

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. You will also likely have to file some taxes on behalf of the deceased. Any estate thats worth less than 117 million does not owe estate tax.

Odds are you still wont have to pay an inheritance tax. New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. However like all other states it has its own inheritance laws including the ones that cover what.

Since this state doesnt collect its own inheritance tax you likely wont have to pay anything. You must complete Form CG to compute your Idaho capital gains deduction. Idaho does not currently impose an inheritance tax.

Nonetheless Indianas inheritance tax was repealed retroactively to January 1 2013 in May 2013. However if the person whom youve inherited money possessions or property from lives in a state that does collect an. Keep in mind that if you inherit property from another state that state may have an estate tax that applies.

However like all other states it has its own inheritance laws including the ones that cover what. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. Twelve states and Washington DC.

Moose Distribution In Europe Maps On The Web Europe Map Map Europe

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Everything You Need To Know Smartasset

States That Won T Tax Your Retirement Distributions Income Tax Income Tax

Idaho Estate Tax Everything You Need To Know Smartasset

Idaho Inheritance Laws What You Should Know Smartasset

Hawley Troxell Has A Skilled Team Of The Best Real Estate Planning Attorneys In Boise For More Detai Estate Planning Estate Planning Attorney How To Plan

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Kickstarter The Brilliant Site That Lets You Fund Strangers Brilliant Ideas Let It Be Kickstarter Stranger

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Idaho Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

File Bierstadt Map Gif Albert Bierstadt South Dakota Old Maps

4 Things You Need To Know About Inheritance And Estate Taxes

Insurance Companies Accounting Services Certified Accountant Insurance Company

Pin On Setting My House In Order

States With Highest And Lowest Sales Tax Rates

Land Patent And Blm How To And Ownership Rights Of Inheritance And Search Youtube Land Patent Stop Trustee Sale Foreclosure Foreclosures Free Webinar Real