child tax credit 2022 passed

31 2022 in his Build Back Better plan. One final blast of cash is set to arrive Wednesday for roughly 36 million families.

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

13 2021 in Washington DC.

. Children draw on top of a canceled check prop during a rally in favor of the child tax credit in front of the US. But without intervention from Congress the program will instead revert back to its original form in 2022 which is less generous. Part of the American Rescue Plan passed in March the existing tax credit increased from 2000 per child to 3600 per child under the age of 6 with 3000 for children.

So parents could only receive half their total child tax credit money 1800 or 1500 via those payments -- 300 per child per month under age 6 and 250 per child per. Ad Discover trends and view interactive analysis of child care and early education in the US. It is a dollar-for-dollar reduction in taxes that a range.

Child Care Assistance Earned Income Tax Credit EITC and Child Tax Credit CTC Energy Assistance EA Food Assistance Electronic Benefits Transfer EBT EBT Retailer Information. This new law will send. The child tax credit would fall to 2000 next year absent intervention from Congress.

Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. The advance is 50 of your child tax credit with the rest claimed on next years return. However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to. As part of the 2017 tax overhaul Congress doubled the existing child tax credit to 2000 per child under age 17 at year-end. This Act may be cited as the Child Tax Credit for Pregnant Moms Act of 2022.

The American Rescue Act of 2021 temporarily increases the Child Tax Credit up to 3600 per child under age six and up to 3000 per child under age 18. Prior to the American Rescue Plan parents could only claim 35 of a maximum of 6000 in child care expenses for two children or a maximum tax credit of 2100. In the meantime the expanded child tax credit and advance monthly payments system have expired.

The boosted Child Tax Credit pulled millions of children out of poverty in 2022. The benefit is set to. So far the enhanced credit hasnt been back in play even though President Biden has pushed for it.

A In general. As we mentioned the Child Tax Credit provided a necessary and critical boost to American families in 2021 via the American Rescue Plan the COVID-19 relief package that was. The good news is.

It also provided monthly payments from July of 2021. Child tax credit allowed with respect to unborn children. As of right now the 2022 child tax credit which you would get when you file in 2023 is set to go back to 2000 for each dependent age 17 or younger.

1 day agoStaff Report May 28 2022 412 PM. Tax Changes and Key Amounts for the 2022 Tax Year. There are thousands of households set to receive a child tax credit worth as much as 750 in only five days.

Senate which has yet to vote on the Build Back Better Act legislation that passed the House of. The first one applies to. Ad The new advance Child Tax Credit is based on your previously filed tax return.

As of right now the Child Tax Credit will return to the typical amount 2000 per dependent up to age 16 for the 2022 tax year and there will be no advance payments offered to families. It is also poised to drop again to 1000 in 2026. Get the up-to-date data and facts from USAFacts a nonpartisan source.

The child tax credit isnt going away. Latest child tax credit money arrives Dec. But dont count on extra cash in 2022.

The fate of extending the child tax credit expansion in 2022 lies with the US. Washington lawmakers may still revisit expanding the child tax credit.

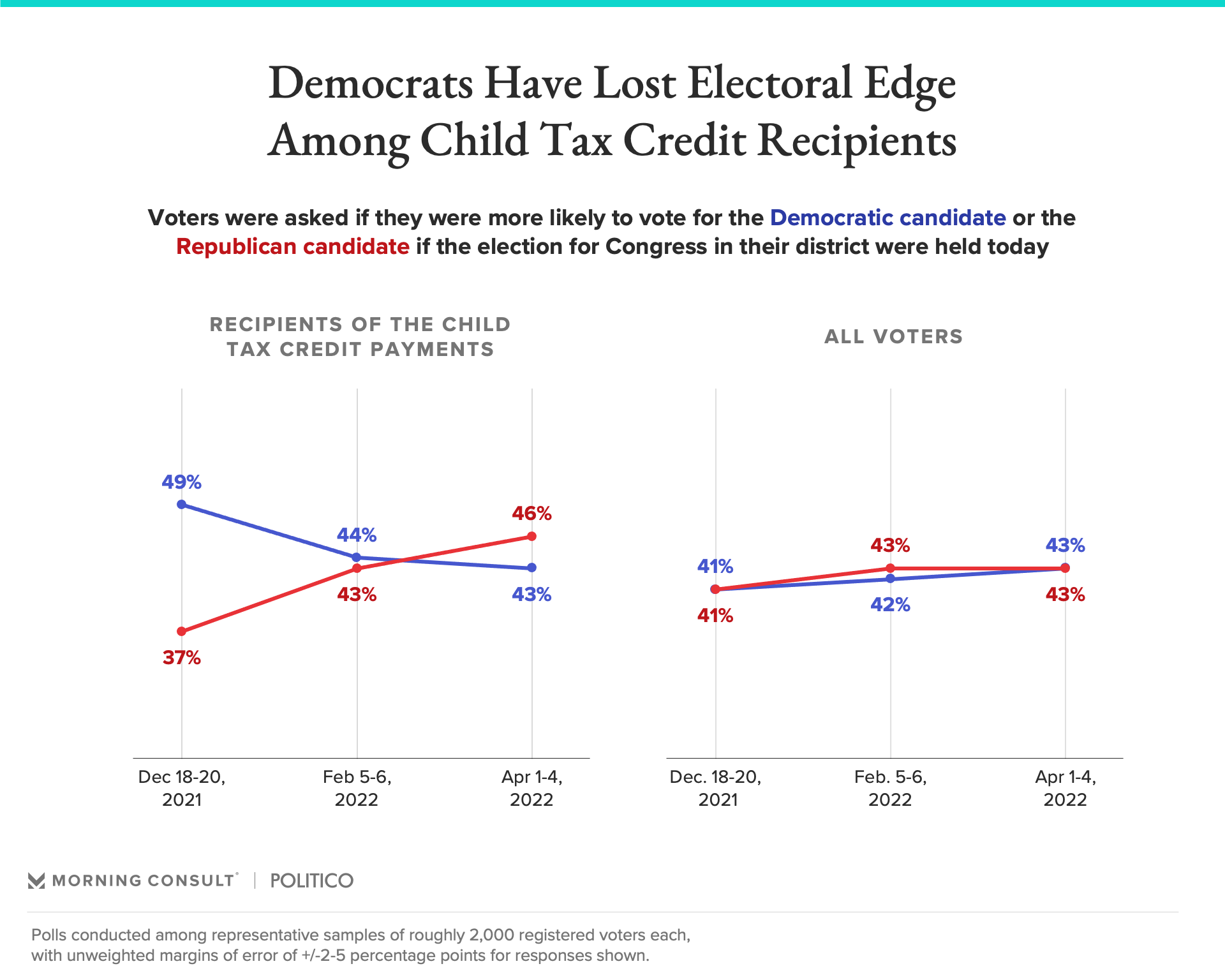

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

The Child Tax Credit Toolkit The White House

The Child Tax Credit Toolkit The White House

/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Gst Input Tax Credit Mismatch Report App Google Play App Store

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423480/GettyImages_1358862098.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

The Monthly Child Tax Credit Payments Are Done Here S What Will Replace It Fortune

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times